How To Check Tumblr Blog Start Date

Open B9 Account in minutes

No credit checks

No minimum balance

Fully online

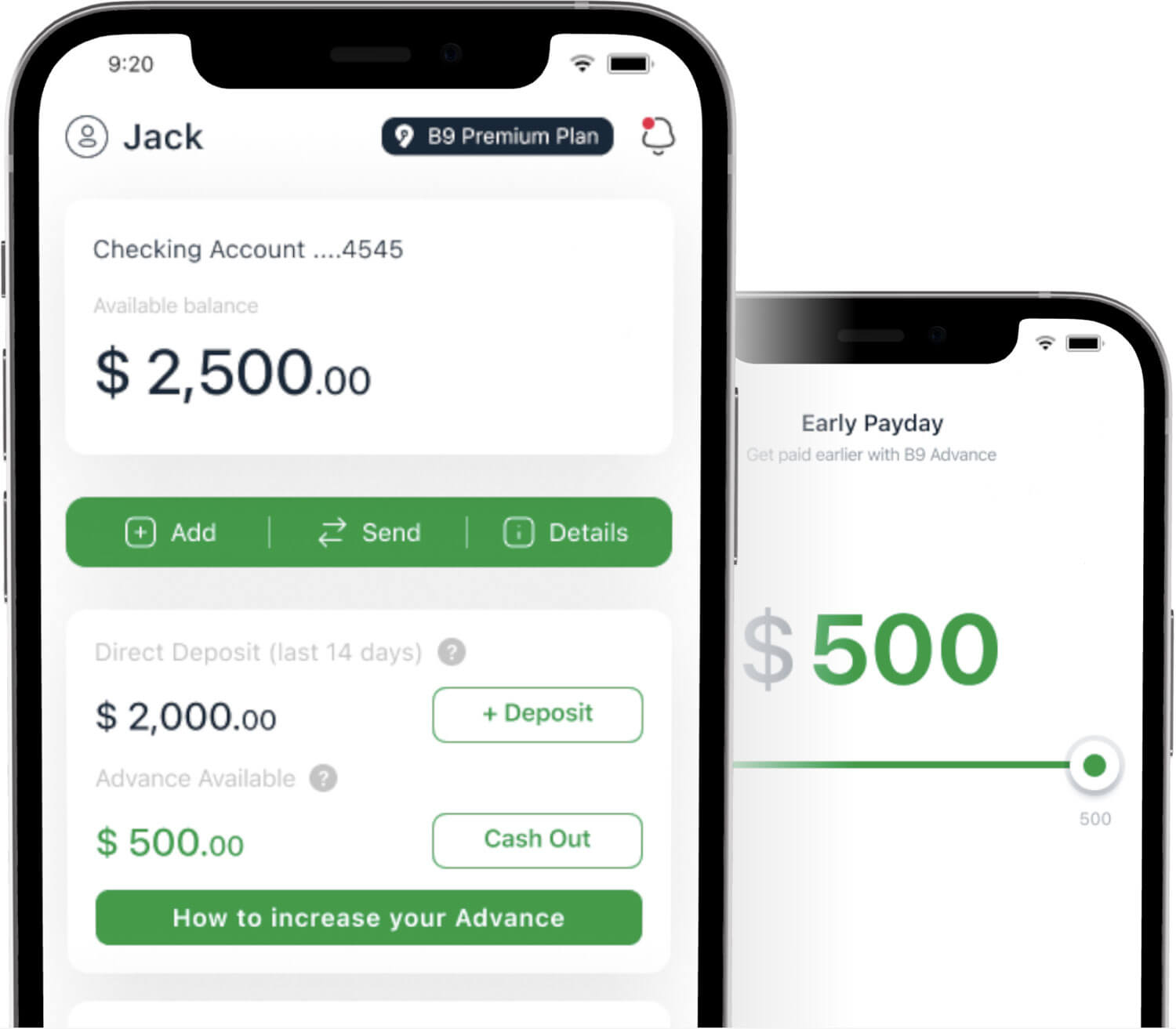

Everyday banking with B9 Mobile App

B9 Visa® Card

Pay everywhere with B9 Visa® Card or withdrawn cash from ATM

B9 Advance

Get your paycheck up to 15 days early

Fee Free bank transfers

ACH and internal transfers fee fee for B9 Members

Easy to apply,

Easy to use

Both SSN or ITIN are accepted in order to open your B9 account. You can easily connect B9 to any payroll platform to set up your direct deposit with B9.

There is a small $4.99 a month subscription fee for a B9 account which includes a B9 Visa debit card. Open your online bank account in 5 minutes with no minimum balance required, Start making purchases online with your B9 virtual card which is assigned instantly. No overdraft fees, no minimum balance required. Get your B9 debit card now.

GET YOUR B9 VISA® DEBIT CARD

Everyday banking with

NO credit checks,

NO minimum balance,

NO overdraft fees.

![]()

Only need

SSN or ITIN!

SSN & ITIN are accepted to open B9 Account.

![]()

Instant

cash

Instant transfers between B9 members.

![]()

B9 Visa®

Card

Pay everywhere with your B9 Visa® Card or withdraw cash from ATM.

Charles Mcclenan

The joy I never knew until now. I was skeptical at first but it wasn't a scam. I was able to get a part of my check the first time and it had me questioning the app. But after my second deposit I was able to get my whole check and I never looked back. Never felt financially secure before this app knowing that am covered for emergency by my own money best feeling in the world. Thank you guys for giving me and my family joy unknown

John Hardy Sr

Great Experience and will continue to Use!!!! Everything is real and legit. Deposit are on time which usually is two days early and the advances really does help in a time of need. THANKS B9!!!

Kayla Krauter

Amazing app, it's so easy to use! Customer service is always super quick to respond and resolve whatever needs their attention. I always know my money's safe when I bank with B9!

Janaya Andrews

I love the app so much it makes everything fast and easy to get to and when your low on funds this app really does help with that problem a lot I know that this app helps me so hey why don't you go ahead and download this app for your next payday

Michael

This great I got my pay check on time and I got to borrow money to pay off my bills. Still waiting on my card but I was still able to use without it,thank you so much

Darliene

I was in a tight pinch and b9 advanced me $100 at 1st I wasn't sure about this app but they actually pulled through. I'm definitely sticking with b9:)

Dom Delacruz

A Banking app you can trust! This online banking app is one of the best I have used so far. They are new and upcoming but yet they are built and based around the customer. Which is hard to come by now a days. There customer service is amazing and there additional features really help out. Especially during this hard times. (COVID)

Peter Davidson

At first I was Skeptical of this app. A lot of paycheck advancement app are Deceiving and hard to set up and are not 100% honest. B9 was actually simple and they kept there word on Everything they advertise.I got a paycheck advancement easy and quick without any fees. I would definitely recommend this app. My experience was great the only thing I would change would be that the app lets you transfer money to a debit card instantly. Plus Be compatible with Apple wallet and Apple Pay. Besides that the app is amazing and I will be using this app as my main go to when times are hard. Thank you Plus customer service it's very helpful and they respond quick. Hundred percent recommend this to anyone and everybody

AG

This is a great app to have especially when you're running low on cash and don't know what To do you can always count on b9 to come through

Aerie Lee Morgan

B9 has helped me in my financial situation so much since I have been utilizing there services. They make it easy to pay back the loan and receive one too.

Marcus Goodwin

B9 is a awesome and really helps when you need extra money.Also I like the fact it helps wen your are in a quick emergency , I would most definitely recommend them to anyone.

Elyanna Alvarez

I love b9 my direct deposit comes in earlier than my normal bank! I also love the cash advance option as I sometimes need my paycheck asap. Awesomeness

GENERAL FREQUENTLY ASKING QUESTIONS ABOUT BANKING AND ADVANCES

How many banks can you have accounts with?

There is no existing limit for you in the number of banks, as well as in the number of bank accounts. You can have as many as you wish or need. Another thing is that after a certain amount, banks can charge you a fee for having so many. That is why you need to put some thought into deciding how many is enough. The general number would be 4, where one pair is for general spendings, such as bills and everyday purchases, and another one is for savings. You�ll need a separate account for emergency conservations and for other means, such as investing or college funds.

How to open a bank account for a minor?

As a rule, banks do not allow minors to create a bank account without an adult�s involvement. In most cases, a joint owner is represented by the child�s parent or guardian. Once you have decided to develop the kid�s financial habits, specify the exact procedure you need to go through. Some banks will require visiting a local branch in person; others (modern ones) will ask you to install their app and fill out an online application form. You will have to prepare a documentation package including your SSN, driver�s license (or passport), your child�s birth certificate, or school ID (contact a bank representative over the phone for more precise information). In most cases, after you complete the application process, you have to deposit a certain amount of money into the new account. If it is not a custodial account and the kid has access to it, the bank will issue a card that the child can use to make purchases and manage funds at an ATM.

How much are bank accounts insured for?

Usually, the insurance is paid to the clients of the bank when it is getting closed or can no longer provide previous services to its depositors. The standard insurance of a bank account is 250 thousand dollars. There are different categories of bank accounts for which the insurance amount may change. 250.000 is only the starting price of the coverage. In joint accounts, for example, the cost of the insurance is 250 thousand dollars for each of the owners.

How to unfreeze a bank account?

Your first step is to find out why the bank froze your account and what is your following plan of action. If you have an unpaid debt, the credit company can withdraw the money from your account or take the remaining funds. If you are in such a situation, file for bankruptcy as soon as possible. However, if you can pay this debt, it is better to pay the required amount to handle the problem. In both cases, your bank account will be unfrozen again after you pay all the money you owe. If suspicious frauds are committed using your card, and the bank has decided to freeze it, you should contact find out what the problem is. Most often, it is enough just to confirm your card is safe.

How to close us bank account?

To close a US bank account can seem to be a difficult task. However, if you do everything right, it would not be daunting at all. First of all, you need to open a new account in another bank and transfer your finances and automatic payments to a new account. Afterward, close your old account. It is simple, just call the bank or go to a local branch. The whole procedure should not take more than 30 minutes. Some banks even allow closing an account online. When you finished, it is necessary to ask written statement from the bank that confirms that your account is closed.

What happens to a bank account when someone dies?

The easiest situation is when the person that passed away ascribed a Payable on a Death person. This means that a bank account has its own beneficiary, which will have access to it after the death of its owner. In other cases, a will of a dead person will help his/her close ones to answer that question. When probate wasn�t created, then the inheritance, bank accounts included, will be divided by the law.

What can someone do with your bank account number?

Nowadays, most people are giving their bank account numbers in many instances, and many of them are afraid of the possibility of misusing this information with malicious intent. However, in fact, there is almost nothing to be afraid of because even the most experienced fraud can do nothing to your money, having only your bank account number. Nevertheless, you have to be prudent anyway because if someone gets your bank account number alongside other personal information, the possibility of becoming a victim of fraud will increase.

What documentation do i need to open a bank account?

Before going into these details, you need to remember that only those 18 years old can create a bank account for themselves. Otherwise, a joint account with your parents is the way to go. In any case, name, current address, and phone number are the first things to be required. Then, two identification documents will be asked of you, as well as the social security number. If opening a student checking account, validation of your affiliation with a certain university will be needed. An additional criterion for some banks is a minimum initial deposit.

What can someone do with your bank account number and routing number?

In the era when almost everyone has a bank account, a lot of purchases and other financial operations involve a bank account number and routing number. Many people hesitate to give up this information because they are afraid that they can become victims of fraudsters. But the question is, what, in fact, can be done to you if someone gets access to this data? We can start with the good news, and it is almost impossible to hack your online banking service using this information. However, you can still lose money through unauthorized transfer or become a victim of ACH fraud because these operations could be easily done with your bank account number and routing number.

How to transfer money from an unemployment card to a bank account?

An employment card works the same way as any other debit card. The only difference is that it is provided by the state Unemployment Office, which sends you payments if you don't have a job every month to support you. As with any other debit card, you can transfer these payments to your bank account using a direct deposit transfer to make the management of this money more convenient. This is an indispensable option, especially if you need to pay bills and other debts. For receiving such a card, you need to make sure that you fit the category of people who can get it, then claim for it and wait for a couple of weeks until you can receive it.

How to transfer money from a credit card to bank account?

If you want to transfer money from a credit card to a bank account, think about it several times. Unfortunately, these cards are mainly intended for paying for various services. When transferring money from a credit card, the bank may charge interest, which will affect your financial situation. However, if you still decide to transfer payment, do the following. Download the online application, enter all data, and select the card for debiting funds. You need to specify the exact sum of the transfer and the recipient's account.

How to find bank accounts in your name?

Nowadays, this is a frequent case when a person has several accounts ascribed to one name � different accounts might serve different purposes, and this is a smart and convenient solution. However, this situation might lead to the fraudsters trying to create accounts in your name or getting access to your already existing accounts. That is why it is useful to know how many and of which type you do have accounts in the banks. To find it out, you should pay attention to your credit report. A credit report is a sort of summary of the account-related information connected with a certain name. Thus, if you are interested in finding out which accounts are attached to your name, a credit report is the first thing you have to check.

Free download for iOS and Android

No extra apps needed to move your funds

Legal

Contacting B9 Customer Support

B9's Customer Success Team is here to help you when you need us!

For faster assistance, our FAQ has answers for our most frequently asked questions and is available to you 24/7.

In-App Support

Our Agents are available for B9 members via in-app support tab:

Mon-Fri: 5 AM to 9 PM Pacific Standard Time (8 AM to 12 AM Eastern Standard Time)

Sat-Sun: 6 AM to 6 PM Pacific Standard Time (9 AM to 9 PM Eastern Standard Time)

Email Us You may email us at support@bnine.com, one of our friendly Customer Success Team members will answer in 24-48 hours.

For additional support you may phone us by clicking on the FAQ for our hours of availability.

Complaints

Banking services are provided by Mbanq banking partners, Members FDIC. To report a complaint relating to banking services, email compliance@mbanq.com

- ✅ How to check how old your tumblr account is

- ✅ Open a bank account with B9!

- ✅ How to check how old your tumblr account is - Bnine

How to check how old your runescape account is

Pay everywhere with your B9 Visa® Card or withdraw cash from ATM.

How to check how old your steam account is

Both SSN or ITIN are accepted in order to open your B9 account. You can easily connect B9 to any payroll platform to set up your direct deposit with B9.

How to check how old your twitter account is

There is a small $9.99 a month subscription fee for a B9 account which includes a B9 Visa debit card. Open your online bank account in 5 minutes with no minimum balance required, Start making purchases online with your B9 virtual card which is assigned instantly.

How to check hub id on bank of america account

No overdraft fees, no minimum balance required. Get your B9 debit card now.

More account check 6 links

How To Check Tumblr Blog Start Date

Source: https://bnine.com/account-check-6/how-to-check-how-old-your-tumblr-account-is/

Posted by: wilcherinizing.blogspot.com

0 Response to "How To Check Tumblr Blog Start Date"

Post a Comment